A Singular Diluter

An overhang of warrants and convertibles plagues Singularity Future Technology Ltd.

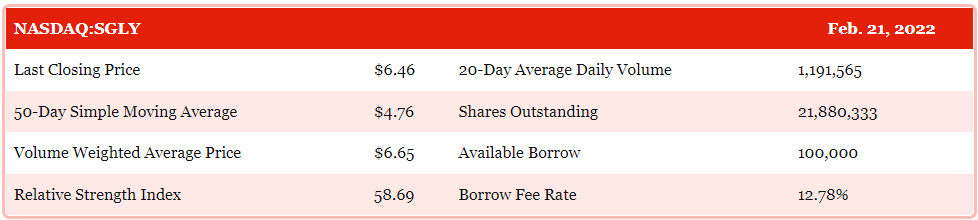

Shares of Singularity Future Technology Ltd. (SGLY 0.00%↑) more than doubled in price during the past three weeks before closing down 9.9% at $6.46 per share last Friday. At no time before or during the rally was any earth-shattering news about the company released.

The jump in price was accompanied by unusually high trading volume. On Feb. 16, for example, 3,471,000 shares traded hands, which was more than three times the 30-day average. The stock closed up 21% that day at $7.42 per share.

It’s not clear whether anyone in particular was bidding up the price, although certain parties stood to benefit more than the average momentum investor. As of Dec. 31, Singularity had 12,618,614 exercisable warrants outstanding with a weighted average exercise price of $5.30.

Incentive to exercise

Holders of, for example, the warrants issued on Feb. 10, 2021 could have profited last week while the stock was trading as much as 16% above the warrants’ exercise price of $6.81. Holders of the warrants issued on Dec. 11, 2020, which have an exercise price of $3.10, could have profited even more.

Just how many of Singularity’s exercisable warrants remained outstanding last week is uncertain. On Jan. 6, the company spent $7,948,000 to buy back 3,974,000 warrants with exercise prices ranging from $6.81 to $8.75. At $2.00 per warrant, investors who participated in the buyback made out better than they would have by exercising the securities last week. But the repurchased amount represented only 31% of Singularity’s total outstanding exercisable warrants as of Dec. 31.

The owners of Singularity’s warrants are hedge funds that frequently participate in PIPE (private investment in public equity) offerings. For example, Hudson Bay Capital Management LP, which we wrote about last week, and Lind Global Partners, LLC, which we wrote about three weeks ago, owned 1,011,666 and 790,000 of Singularity’s warrants, respectively, at the end of 2021.

Beginning of the end

To be clear, we aren’t suggesting that anyone manipulated Singularity’s stock price or violated securities laws. We don’t have access to any prime broker’s purchase and sales records. We are simply pointing out who stood to gain from the rally, which, of course, includes anyone who bought low and sold high.

Although the rally appears to be over for now, we believe a gradual decline in Singularity’s stock price is just beginning. The company began life in 2001 as Sino-Global Shipping America Ltd. Since inception, it has operated mostly as a shipping agent, which is a low-margin business providing administrative services to shipping companies.

Singularity has been trying to expand into new businesses since 2018, but earnings and positive cash flow have proven elusive. The company has financed its operations largely through registered direct offerings and private placements of common stock, warrants, convertible preferred shares, and, most recently, convertible notes.

A glut of shares

In 2013, Singularity began a multi-year expansion into shipping and chartering, inland transportation management, and freight logistics. To finance the plan, the company filed shelf registrations to sell up to $60,000,000 of equities in aggregate. In 2017 and 2018, Singularity raised a total of $6,900,000 in two registered direct offerings of common shares and a private placement of warrants.

The flood of new shares into the market took a toll. From Jul. 2018 through Jun. 2020, Singularity’s stock price fell from $1.17 to $0.61 per share while its total shares outstanding ballooned from 12,864,913 to 18,593,940. Meanwhile, the company’s net loss increased from -$6,533,844 in fiscal 2019 to -$16,452,894 in fiscal 2020 due to a $14,910,502 bad debt expense the company blamed on the COVID-19 pandemic.

After receiving a delisting notice from NASDAQ, Singularity effected a one-for-five reverse stock split in Jul. 2020, which brought its stock price up to $2.22 per share. But within four months, the company began issuing dilutive securities again, selling convertible preferred stock, warrants, and common shares in rapid succession.

Pivot to blockchain

In Jan. 2021, Singularity began a strategic shift toward cryptocurrency and blockchain technology–a significant departure for a shipping company. To finance the plan, the company filed a shelf registration in Feb. 2021 for up to $200,000,000 of equities and sold warrants to purchase up to 5,653,500 common shares at exercise prices of $6.81 and $7.80. The company’s stock price reached a new 52-week high of $12.28 per share while total shares outstanding swelled from 7,460,744 to 14,447,060 in 22 days.

Singularity announced that it was buying $4,600,000 of cryptocurrency mining equipment, acquiring a majority stake in blockchain service provider Super Node LLC, and launching a new exchange for NFTs (non-fungible tokens). But by Nov. 29, 2021, the company’s stock price was back down to $2.27. For the fiscal year ended Jun. 30, 2021, Singularity reported a net loss of -$6,823,343 on revenues of $5,151,032, which had fallen 21% from the previous year. Revenues in its core shipping agency segment had fallen 90%.

In Nov. 2021, Singularity announced the resignation of its CTO, Mr. Xintang You, after less than a year on the job. Two board members also resigned, and the company’s VP, Mr. Yang “Leo” Jie, succeeded Mr. Lei Cao as CEO. The following month, the company sold 3,228,807 shares of common stock, warrants to purchase 4,843,210 shares of common stock, and two convertible notes priced at $10,000,000 in aggregate. In Jun. 2022, the warrants will become exercisable at $4.00 per share, and the notes will become convertible at $3.76 per share.

The company formally changed its name to Singularity Future Technology Ltd. last month, doubling down on blockchain. As of Dec. 31, 2021, Singularity had $51,401,410 in cash, which should last about three and a half years at the company’s current monthly burn rate. But with another flood of dilutive shares poised to hit the market, we believe the history of Singularity’s stock price will repeat.

This article appeared originally on The Activist.